Does paypal send you a 1099 information

Home » Trend » Does paypal send you a 1099 informationYour Does paypal send you a 1099 images are ready. Does paypal send you a 1099 are a topic that is being searched for and liked by netizens now. You can Download the Does paypal send you a 1099 files here. Get all free images.

If you’re searching for does paypal send you a 1099 images information linked to the does paypal send you a 1099 interest, you have pay a visit to the right blog. Our website always provides you with suggestions for viewing the highest quality video and image content, please kindly search and find more enlightening video content and images that match your interests.

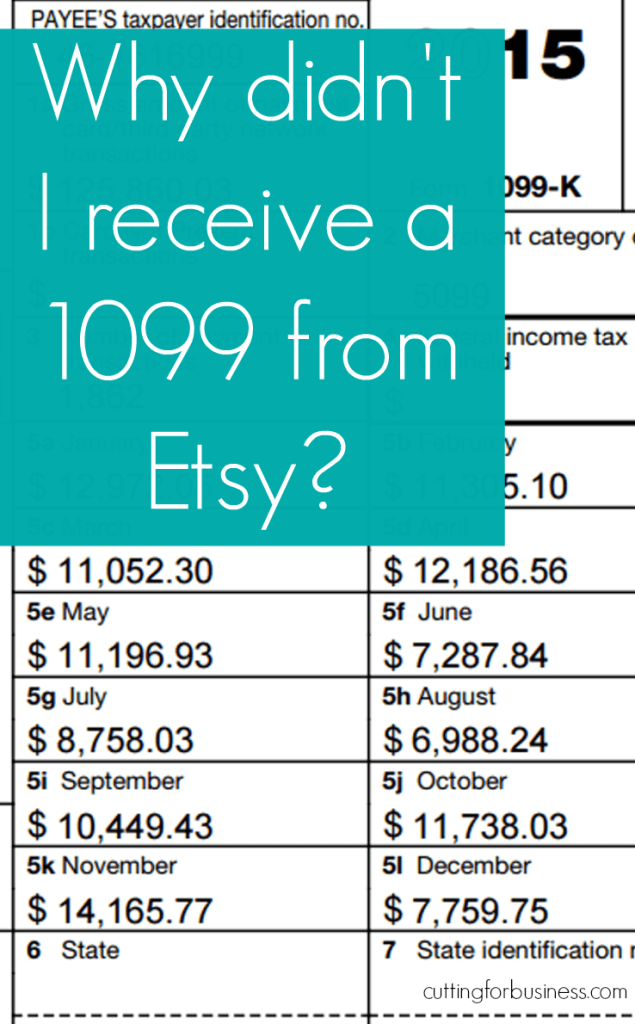

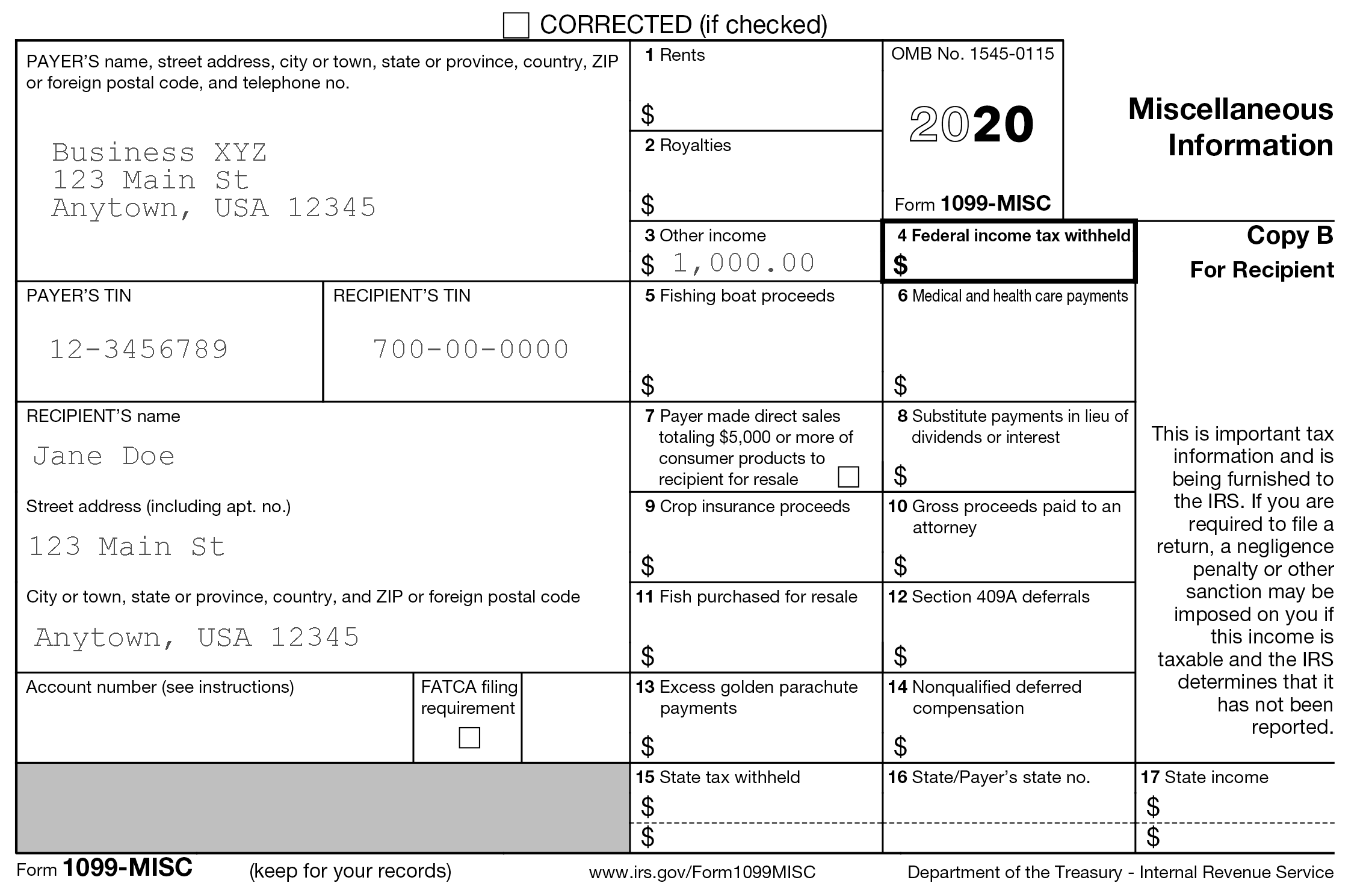

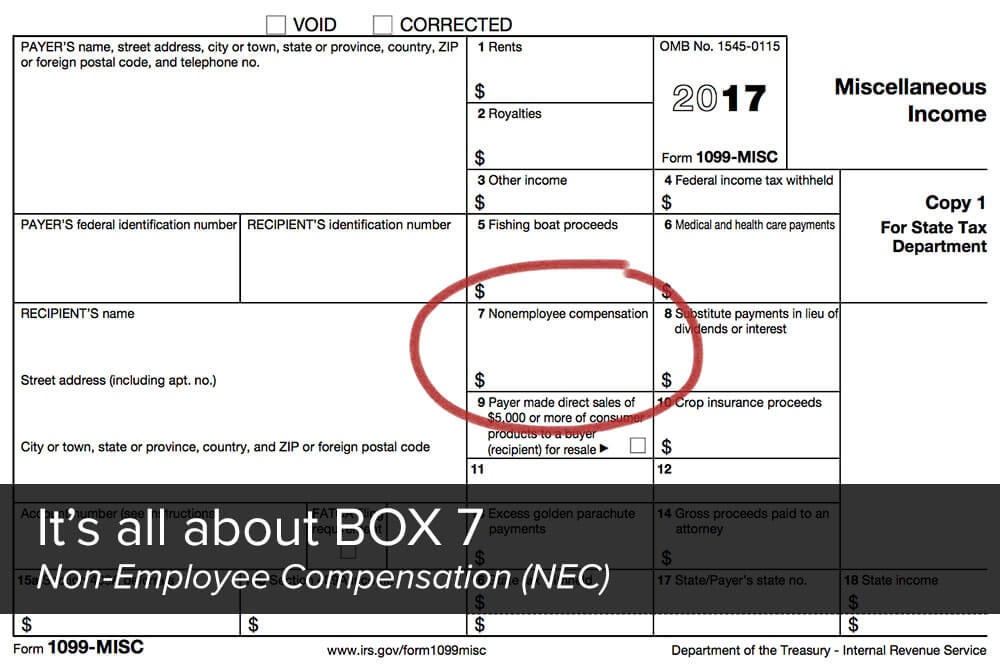

Does Paypal Send You A 1099. Learn more and manage your cookies I did not receive a 1099 i called paypal and they said they will not be sending one because i did not make enough. If you have $599 capital gains then you owe tax on that $599, even though paypal didn�t 1099 you. The recipient of that 1099 then can adjust their net income as needed.

Bookkeeping Blog SILVER LEAF OFFICE From silverleafoffice.com

Bookkeeping Blog SILVER LEAF OFFICE From silverleafoffice.com

Maybe you send some money to a family member via paypal to help out with an emergency. I did not receive a 1099 i called paypal and they said they will not be sending one because i did not make enough. It is your responsibility to determine whether or not you owe capital gains taxes to the irs. Cookies help us customize the paypal community for you, and some are necessary to make our site work. You work as a consultant. That is the case even if you paid the recipient more than $600 last year.

This is the first year i will be receiving a 1099 from paypal for my ebay and facebook sales.

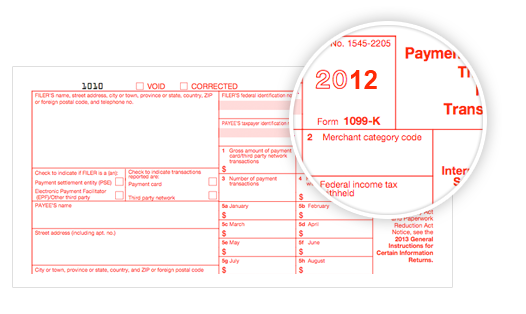

Your clients pay you $30,000 via paypal. Over $20,000 in gross payment volume from sales of goods or services (not personal payments), and over 200 separate payments for goods or services. You have more than 200 transactions. Your clients pay you $30,000 via paypal. As you can see here, paypal is required to send 1099s to the irs if a person receives over $20,000 and receives over 200 payments in a year. Getting a 1099 from paypal does not mean you owe capital gains taxes.

Source: medium.com

Source: medium.com

Is it ok if we also use cookies to show you personalized ads? Is it ok if we also use cookies to show you personalized ads? It is your responsibility to determine whether or not you owe capital gains taxes to the irs. You can include it in your reconciliation as well. We’ll use cookies to improve and customize your experience if you continue to browse.

Source: zoho.com

Source: zoho.com

Over $20,000 in gross payment volume from sales of goods or services (not personal payments), and over 200 separate payments for goods or services. Learn more and manage your cookies The new reporting requirement only applies to sellers of goods and. You do not have to issue the contractor a 1099. Cookies help us customize the paypal community for you, and some are necessary to make our site work.

Source: marketrealist.com

Source: marketrealist.com

You can include it in your reconciliation as well. The new reporting requirement only applies to sellers of goods and. Cookies help us customize the paypal community for you, and some are necessary to make our site work. The recipient of that 1099 then can adjust their net income as needed. I did not receive a 1099 i called paypal and they said they will not be sending one because i did not make enough.

Source: ericnisall.com

Source: ericnisall.com

Over $20,000 in gross payment volume from sales of goods or services (not personal payments), and over 200 separate payments for goods or services. 1099 information reporting has been around for a long time. <p>can you point me in the direction where to go to do my taxes. Paypal also explains in its crypto documentation that it will be participating in relevant 1099 information reporting for users that buy, sell, and transact in cryptocurrency on its platform. This is the first year i will be receiving a 1099 from paypal for my ebay and facebook sales.

Source:

Source:

It is your responsibility to determine whether or not you owe capital gains taxes to the irs. It is your responsibility to determine whether or not you owe capital gains taxes to the irs. R/paypal is not the place to ask about taxes! Is it ok if we also use cookies to show you personalized ads? With this strategy, you push the reporting requirements to paypal.

Source: blog.accountingprose.com

Source: blog.accountingprose.com

With this strategy, you push the reporting requirements to paypal. 1099 information reporting has been around for a long time. Is it ok if we also use cookies to show you personalized ads? You can include it in your reconciliation as well. R/paypal is not the place to ask about taxes!

Source: jackeesuperstar.blogspot.com

Source: jackeesuperstar.blogspot.com

And no, the 1099 jfrom paypal does not include f&f payments. However, this rule was recently changed in massachusetts and vermont laws, whose sellers only have to make $600 to trigger a 1099. Your clients pay you $30,000 via paypal. Your gross earnings are more than $20,000, and; Is it ok if we also use cookies to show you personalized ads?

Source: silveiraphoto.blogspot.com

Source: silveiraphoto.blogspot.com

This is the first year i will be receiving a 1099 from paypal for my ebay and facebook sales. Cookies help us customize the paypal community for you, and some are necessary to make our site work. Over $20,000 in gross payment volume from sales of goods or services (not personal payments), and over 200 separate payments for goods or services. You will also receive a copy of this form. Your gross earnings are more than $20,000, and;

Source: jeka-vagan.blogspot.com

Source: jeka-vagan.blogspot.com

If you have $599 capital gains then you owe tax on that $599, even though paypal didn�t 1099 you. Is it ok if we also use cookies to show you personalized ads? The recipient of that 1099 then can adjust their net income as needed. However, this rule was recently changed in massachusetts and vermont laws, whose sellers only have to make $600 to trigger a 1099. Over $20,000 in gross payment volume from sales of goods or services (not personal payments), and over 200 separate payments for goods or services.

Source: amynorthardcpa.com

Source: amynorthardcpa.com

R/paypal is not the place to ask about taxes! However, this rule was recently changed in massachusetts and vermont laws, whose sellers only have to make $600 to trigger a 1099. Maybe you send some money to a family member via paypal to help out with an emergency. 1099 information reporting has been around for a long time. You can include it in your reconciliation as well.

Source: dinesentax.com

Source: dinesentax.com

I did not receive a 1099 i called paypal and they said they will not be sending one because i did not make enough. You work as a consultant. This is the first year i will be receiving a 1099 from paypal for my ebay and facebook sales. Over $20,000 in gross payment volume from sales of goods or services (not personal payments), and over 200 separate payments for goods or services. You have more than 200 transactions.

Source: hudoznik-bunkov.blogspot.com

Source: hudoznik-bunkov.blogspot.com

Your clients pay you $30,000 via paypal. Your clients pay you $30,000 via paypal. 1099 information reporting has been around for a long time. That all came through paypal. The recipient of that 1099 then can adjust their net income as needed.

Source: karmichattrick.blogspot.com

By browsing this website, you consent to the use of cookies. It is your responsibility to determine whether or not you owe capital gains taxes to the irs. And no, the 1099 jfrom paypal does not include f&f payments. You have more than 200 transactions. This pushed the reporting requirements to paypal.

Source: bluesummitsupplies.com

Source: bluesummitsupplies.com

Cookies help us customize the paypal community for you, and some are necessary to make our site work. You have more than 200 transactions. R/paypal is not the place to ask about taxes! Cookies help us customize the paypal community for you, and some are necessary to make our site work. 1099 information reporting has been around for a long time.

Source: karablovely.blogspot.com

Source: karablovely.blogspot.com

You have more than 200 transactions. Your clients pay you $30,000 via paypal. Over $20,000 in gross payment volume from sales of goods or services (not personal payments), and over 200 separate payments for goods or services. Your gross earnings are more than $20,000, and; Is it ok if we also use cookies to show you personalized ads?

Source: jackeesuperstar.blogspot.com

Source: jackeesuperstar.blogspot.com

Getting a 1099 from paypal does not mean you owe capital gains taxes. As you can see here, paypal is required to send 1099s to the irs if a person receives over $20,000 and receives over 200 payments in a year. However, this rule was recently changed in massachusetts and vermont laws, whose sellers only have to make $600 to trigger a 1099. You are not required to send a 1099 form to independent contractors such as freelancers, or to other unincorporated businesses such as llcs, if you paid them via paypal or credit card. This year i also received some payments from cookies help us customize the paypal community for you, and some are necessary to make our site work.

Source: hudoznik-bunkov.blogspot.com

Source: hudoznik-bunkov.blogspot.com

It is your responsibility to determine whether or not you owe capital gains taxes to the irs. Maybe you send some money to a family member via paypal to help out with an emergency. You have more than 200 transactions. You do not have to issue the contractor a 1099. However, this rule was recently changed in massachusetts and vermont laws, whose sellers only have to make $600 to trigger a 1099.

Source: in.pinterest.com

Source: in.pinterest.com

1099 information reporting has been around for a long time. 1099 information reporting has been around for a long time. That all came through paypal. Over $20,000 in gross payment volume from sales of goods or services (not personal payments), and over 200 separate payments for goods or services. Your clients pay you $30,000 via paypal.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does paypal send you a 1099 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.